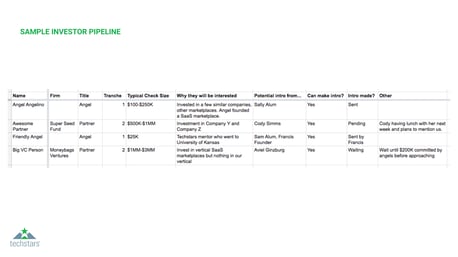

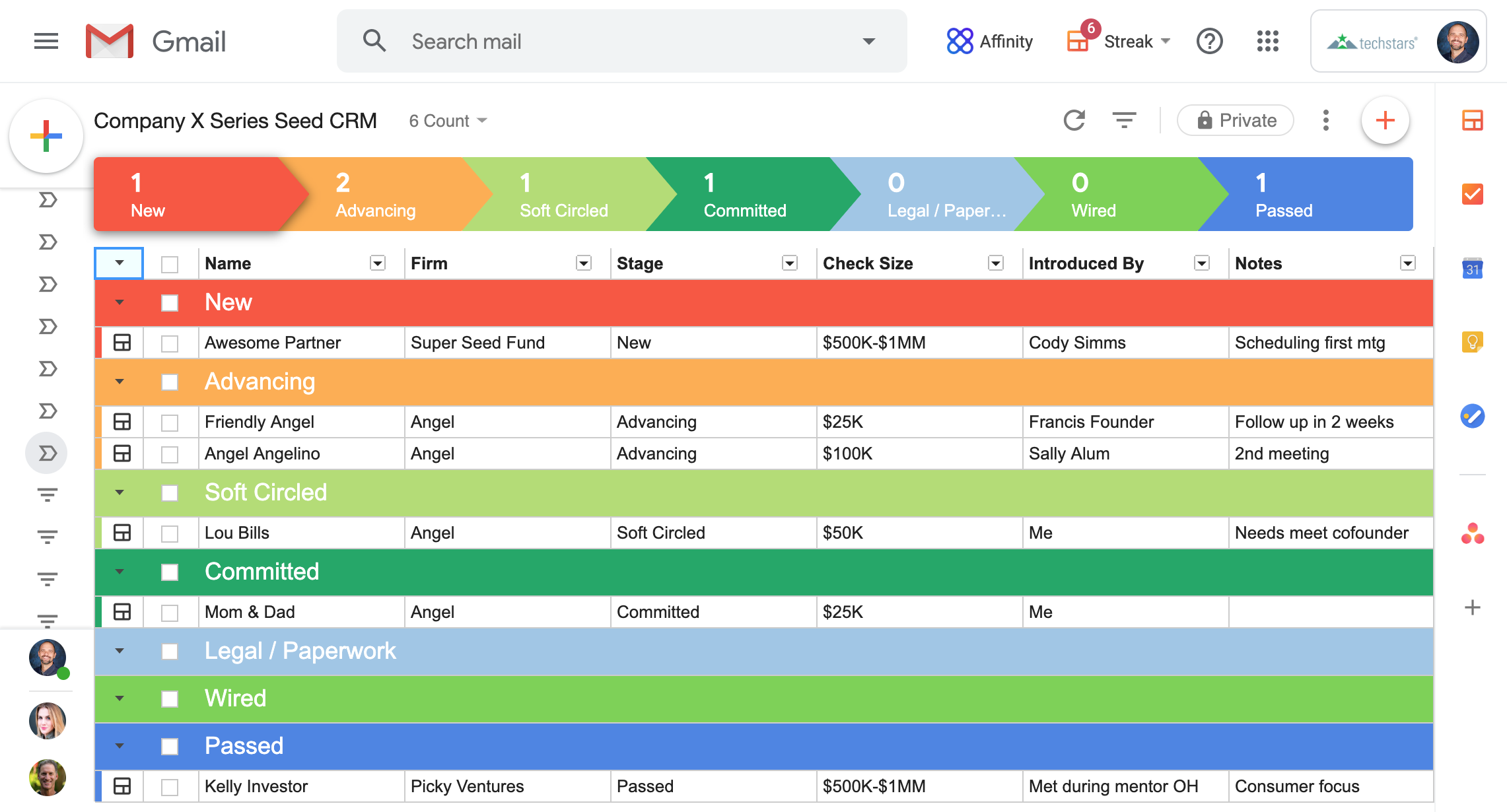

When you are ready to fundraise, informing your mentors, existing investors and allies is important. I would suggest a one-on-one meeting with them first to review your pipeline and/or send a Process Starter email.

A Process Starter email can be sent to your mentors, existing investors, and allies indicating you are actively raising money. It contains some context to the relationship, a few names you’re thinking about targeting, asking for their feedback and volunteering a forwardable email.

Here is an example of a Process Starter email:

To: Cody@mentorX.com

From: CEO@CompanyX.com

Subject: Company X fundraising process

Hi Cody,

As you may recall, we are company x in the Accelerator at Techstars [remind them who you are]. We met on August 10 during your mentor office hours [when you met].

Company x provides [pitch, how you help customers]. We have $20,000 in MRR [traction] and since Techstars, grown revenue 3X and secured 5 new paid pilots.

We are opening up a $$$ seed round and plan to come to LA at the end of the month [specific amount and time boxing the visit]. We’re targeting angels and seed funds [whom you are targeting] focused on revenue-generating SaaS businesses that are ok investing out of their primary geography, as we are based in Chicago [geography info].

In Los Angeles, it looks like Angel Angelino and Awesome Partner at Super Seed Fund could be a good fit [identifying your targets and asking their opinion]. Does that sound right? I would love to find 15 minutes to discuss other ideas you may have and/or if either of those two feels right I can send a forwardable email to you.

Please let me know if I can send more info to you and thanks a ton for thinking about this. Happy to also share our full investor pipeline if you’d like to review it.

Best,

Founder who is about to raise a bundle of cash

The Forwardable Email

The forwardable email is one that your mentor/contact will be sent to an investor on your behalf.

Components to a good forwardable email include:

- Brevity

- Quick and scannable

- Relevant to the investor

- Indicate why are you reaching out

- Requires NO ACTION on the part of the forwarder...they should be able to do it from their phone without editing anything!

Example of a forwardable email:

To: Cody@mentorX. com

From: CEO@CompanyX. Com

Subject: Company X requesting intro to Angel Angelino

Hi Cody,

I’m writing in the hopes that you can help us with an introduction to Angel Angelino as we kick off our fundraising process. We at Company X are opening up a $$$ seed round and are targeting angels and seed funds focused on revenue-generating SaaS businesses that are ok investing out of their primary geography. Given Angel’s recent investments in Blah and YaDaYa, I think she’d find Company X very compelling.

We’ll be in Los Angeles at the end of the month and would love to meet with her. I’d very much appreciate it if you’d pass this along to her to see if she’d be willing to connect.

More info on Company X:

Company X provides customers with the best way to Bla Bla Bla.

The reason that we believe this is a massive opportunity is that future customers have real pain, and the world is shifting to do these new things in a much more rapid timeframe than anyone anticipated and we are first to market. We have $20,000 in MRR and since Techstars, grown revenue 3X and secured 5 new pilots.

Best,

Founder who is about to successfully raise a lot of money