Before you begin the fundraising process, it’s important to build an investor pipeline and get all of your documents in order; Our thought leader Cody Simms refers to this process as preparing your Mise En Place. Once fundraising begins, you’ll want to set up an investor communication tracking system. This worksheet will help you set up your investor pipeline and communications to send to mentors for introductions.

Before you go out and fundraise, it’s important to identify who in your network could be helpful through this process and help broaden your network.

Write down individuals in your network who you’d reach out to and talk about the fundraising process.

Identify when it’s the right time to begin raising capital.

If you are thinking about fundraising in the next 2-3 months, what are the factors that are driving this decision?

Write down 2-3 key milestones you plan to achieve in the next 4-6 weeks that you think will be real boosters to your fundraising efforts.

Mise En Place is a French culinary phrase that means having all the ingredients you need prepped, chopped, grated, etc. before you cook.

This process also applies to fundraising and having your Mise En Place ready – all of your documents and information about your company are prepared before you actually start pitching to investors so you aren’t creating them on the fly.

Recommended Investor Preparation Materials for Your Mise En Place:

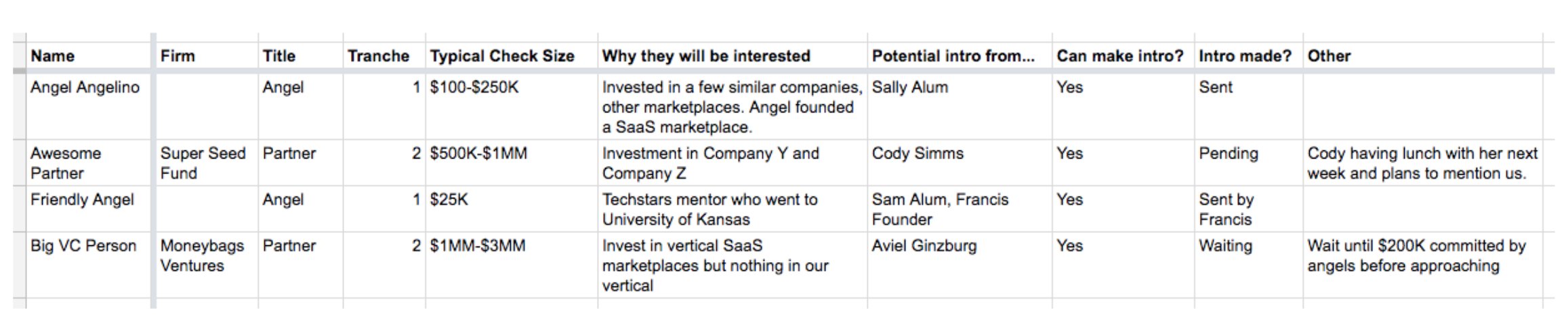

This is a lightweight list of investor targets that you can share with key mentors and allies. Begin to build out an investor pipeline form in Google Sheets so it’s shareable with mentors/contacts in a collaborative way.

Suggested sections of an investor pipeline spreadsheet:

Sample of an investor pipeline:

This is the email you’ll use to personally engage key mentors in your process. The content in this email will alert your mentors you are starting to fundraise, identifies your target investors, requests feedback, asks for introductions, and volunteers a forwardable email.

Your goal here is to create engagement on your fundraise with your key allies. Get them into a meeting or a call with you where you can get a greater share of their attention around your investor pipeline so they spend some time thinking about who might have an interest in investing in your company.

Example of a Process Starter email:

To: Cody@mentorX.com

From: CEO@CompanyX.com

Subject: Company X fundraising process

Hi Cody,

As you may recall, we are company x in the Accelerator at Techstars [remind them who you are]. We met on August 10 during your mentor office hours [when you met].

Company x provides [pitch, how you help customers]. We have $20,000 in MRR [traction] and since Techstars have grown revenue 3X and secured 5 new paid pilots.

We are opening up a $$$ seed round and plan to come to LA at the end of the month [specific amount and time boxing the visit]. We’re targeting angels and seed funds [who you are targeting] focused on revenue-generating SaaS businesses that are ok investing out of their primary geography, as we are based in Chicago [geography info].

In Los Angeles, it looks like Angel Angelino and Awesome Partner at Super Seed Fund could be a good fit [identifying your targets and asking their opinion]. Does that sound right? Would love to find 15 minutes to discuss other ideas you may have and/or if either of those two feel right I can send a forwardable email to you.

Please let me know if I can send more info to you and thanks a ton for thinking about this. Happy to also share our full investor pipeline if you’d like to review it.

Best,

Founder who is about to raise a bundle of cash

Begin to draft out your Process Starter email below:

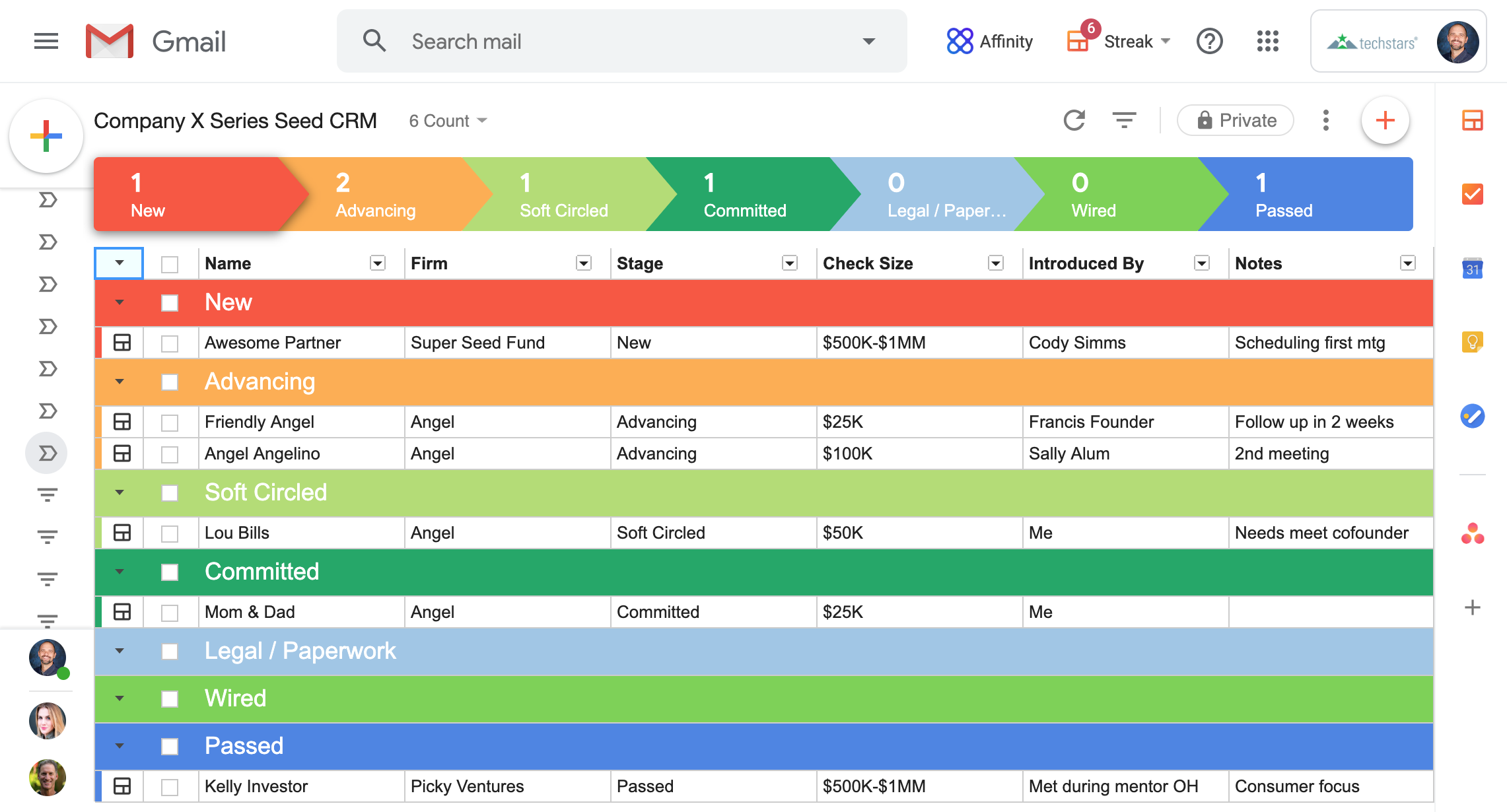

This is the CRM platform you’ll use to manage your fundraising process and interactions.

Sections to consider in a CRM:

Example of an investor tracking CRM format:

This email if for you to send to mentors/contacts when you are actually ready to get in front of an investor and they will forward on your behalf.

The key is to construct this in a way that requires no work on the part of the forwarder and they should be able to do this via their phone with no editing required.

To: Cody@mentorX. com

From: CEO@CompanyX. Com

Subject: Company X requesting intro to Angel Angelino

Hi Cody,

I’m writing in the hopes that you can help us with an introduction to Angel Angelino as we kick off our fundraising process. We at Company X are opening up a $$$ seed round and are targeting angels and seed funds focused on revenue-generating SaaS businesses that are ok investing out of their primary geography. Given Angel’s recent investments in Blah and YaDaYa, I think she’d find Company X very compelling.

We’ll be in Los Angeles at the end of the month and would love to meet with her. I’d very much appreciate it if you’d pass this along to her to see if she’d be willing to connect.

More info on Company X:

Company X provides customers with the best way to Bla Bla Bla.

The reason that we believe this is a massive opportunity is that future customers have real pain, and the world is shifting to do these new things in a much more rapid timeframe than anyone anticipated and we are first to market. We have $20,000 in MRR and since Techstars, grown revenue 3X and secured 5 new pilots.

Best,

Founder who is about to successfully raise a lot of money

Begin to draft your Forwardable email below:

One Pager (Optional)

This is a quick snapshot of your company, traction and other insight that could be helpful to an investor. You may wish to include this in the forwardable email that you send.

Emailable Deck

This is a high-level pitch deck. Be mindful about sending this around because emails can be forwarded and you don’t know where it’ll end up. When you do send a deck, consider using a PDF format or DocSend (though some investors dislike DocuSign as it’s harder to review on the go such as on slow airplane WiFi).

Meeting Deck

This deck will be similar to your emailable deck but will provide more sensitive details such as unit economics or financial models.

Financial Model

By having a well-built financial model, you can have a deeper conversation about the actions you’ll take to increase revenue and grow your company. Remember, one of the biggest things you are trying to do is show prospective investors that you have really thought deeply about your business. Have solid assumptions in a model is a great proof point of this.

Cap Table

Ensure that your cap table is fully up-to-date and accurate as complications here will most certainly create delays in financing.

Data Room

A data room is a shared drive (i.e., Dropbox or Box.com) that contains many of the files above plus other materials you would like investors to review. Typically you won’t share access to your data room until an investor is fairly deep in diligence.

© Techstars 2024 | Privacy Policy | Terms of Use